Unraveling AARP Medicare Supplement Monthly Costs

Navigating the labyrinthine world of health insurance can feel like charting a course through uncharted waters, particularly as we age. The desire for comprehensive coverage intertwines with the realities of budgetary constraints, leaving many seeking clarity and guidance. For those approaching or in retirement, Medicare Supplement insurance, often referred to as Medigap, becomes a crucial consideration. Among the numerous providers offering these plans, AARP's name resonates strongly, prompting the frequent query: How much is AARP Medicare Supplement monthly?

This seemingly simple question belies a complex landscape of variables that contribute to the final premium amount. While AARP licenses its name to UnitedHealthcare, the actual insurer of the plans, the cost of a Medicare Supplement policy isn't a one-size-fits-all figure. It's a tapestry woven with threads of plan type, location, age, and individual health history. Understanding these contributing factors is essential for making informed decisions about one's healthcare future.

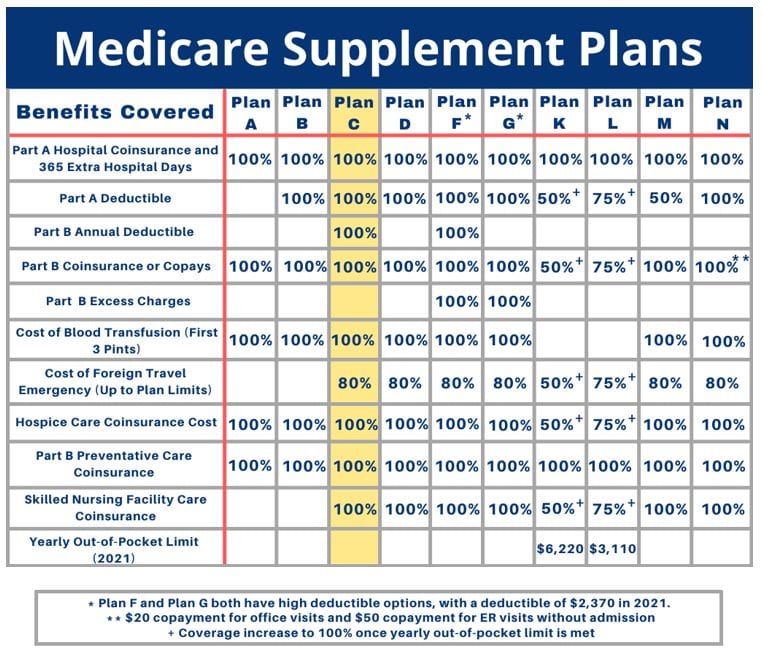

The genesis of Medicare Supplement plans lies in the gaps left by original Medicare coverage. Recognizing that deductibles, coinsurance, and other cost-sharing can place a significant financial burden on beneficiaries, Congress paved the way for private insurers to offer supplemental coverage. These plans, standardized and labeled with letters (Plan A, Plan G, Plan N, etc.), help fill those coverage gaps, providing a safety net against unexpected medical expenses. AARP's involvement in offering these plans stems from its mission to empower individuals to choose how they live as they age, advocating for their health and financial well-being.

A central issue surrounding Medicare Supplement costs revolves around affordability and accessibility. The spectrum of plan options, each offering different levels of coverage and corresponding price points, can be overwhelming for individuals seeking to balance comprehensive coverage with budgetary limitations. The question "How much is AARP Medicare Supplement monthly?" becomes a plea for clarity, a desire to decipher the complexities of the system and find a plan that aligns with individual needs and financial realities.

Furthermore, misconceptions regarding AARP Medicare Supplement plans abound. Some assume that AARP membership automatically grants access to lower premiums or specific plan options. However, while AARP membership offers various benefits, it doesn't directly influence the cost of Medicare Supplement plans offered through UnitedHealthcare. Understanding this distinction is crucial for avoiding confusion and making informed decisions about coverage.

Understanding the cost of AARP Medicare Supplement plans begins with recognizing the factors influencing premiums. These include the chosen plan type, location (as premiums vary by state and even zip code), age, and underwriting guidelines. While pre-existing conditions cannot be used to deny coverage for those eligible for Medigap, they can sometimes affect premium costs.

Choosing the right plan involves balancing coverage needs with affordability. Comparing plan benefits and costs, and seeking guidance from licensed insurance agents specializing in Medicare, are essential steps.

Advantages and Disadvantages of AARP Medicare Supplement Plans

Several websites provide valuable information about Medicare Supplement plans. The Medicare.gov website offers a comprehensive overview of Medicare and Medigap, while UnitedHealthcare's website provides details specific to AARP plans.

Frequently Asked Questions about AARP Medicare Supplement costs:

1. Q: Does AARP membership lower Medigap premiums? A: No, membership doesn't directly impact the cost.

2. Q: Can I switch Medigap plans? A: Yes, under certain circumstances, you may be able to switch plans.

3. Q: Are there discounts available for AARP Medicare Supplement plans? A: Contact UnitedHealthcare to inquire about potential discounts.

4. Q: What are the different AARP Medicare Supplement plan options? A: AARP/UnitedHealthcare offers standardized Medigap plans, such as Plan G and Plan N.

5. Q: How do I find a local agent specializing in AARP Medicare Supplement plans? A: You can find agents through the UnitedHealthcare website.

6. Q: What is the average cost of an AARP Medicare Supplement plan? A: The cost varies depending on factors like plan type and location.

7. Q: What if I have pre-existing health conditions? A: Pre-existing conditions may affect your premium, but you cannot be denied coverage if eligible for Medigap.

8. Q: How do I apply for an AARP Medicare Supplement plan? A: You can apply through UnitedHealthcare.

Tips for Navigating AARP Medicare Supplement Costs:

Compare plan premiums from different insurance companies offering Medigap in your area.

Consult with a licensed insurance agent specializing in Medicare to discuss your individual needs and budget.

In the tapestry of retirement planning, understanding the intricacies of healthcare costs is paramount. The question "How much is AARP Medicare Supplement monthly?" represents a vital step in this journey. By unraveling the factors influencing premiums, exploring plan options, and seeking expert guidance, individuals can navigate the complexities of Medicare Supplement insurance with confidence. The benefits of securing comprehensive coverage can provide peace of mind, allowing individuals to focus on enjoying their retirement years, knowing they have a safety net in place. Embracing informed decision-making empowers individuals to take control of their healthcare future and secure the financial stability essential for a fulfilling retirement. Don't hesitate to reach out to insurance professionals and resources like Medicare.gov to gain a deeper understanding and make the best choice for your individual circumstances. It’s an investment in your well-being and future security.

The enduring charm of sleigh bell melodies

Nyc marathon accommodation reddit wisdom

Unlock the warmth your guide to pine wood paint