Navigating the Landscape of Medicare Humana Advantage

In the labyrinthine world of healthcare, navigating the choices for coverage can feel like charting a course through uncharted waters. We seek anchors, lighthouses, something to guide us toward secure shores. For many, Medicare Advantage plans, particularly those offered by Humana, represent a potential haven. But what are these plans, and how can we understand their complexities?

Medicare Humana Advantage plans represent a specific type of Medicare health coverage offered by private insurance companies, like Humana, that contract with Medicare. They provide an alternative to Original Medicare (Parts A and B) and often bundle additional benefits, such as prescription drug coverage (Part D) and sometimes vision, hearing, and dental. This bundled approach can simplify healthcare management, offering a one-stop shop for various needs. However, understanding the nuances of these plans is crucial for making informed decisions.

The roots of Medicare Advantage can be traced back to the 1970s with the introduction of Medicare HMOs. Over time, these plans evolved, leading to the Medicare Advantage program we know today, formalized under the Medicare Modernization Act of 2003. This legislation aimed to expand choices for Medicare beneficiaries, offering greater flexibility and potentially lower costs. Humana, a prominent player in the health insurance arena, became a key provider of these plans, contributing to the diversification of the Medicare landscape.

The significance of Medicare Humana Advantage programs lies in their ability to potentially enhance the standard Medicare coverage. By incorporating extra benefits and often featuring lower out-of-pocket costs, they can make healthcare more accessible and affordable for some individuals. However, the landscape is not without its challenges. Navigating network restrictions, understanding coverage limitations, and choosing the right plan from a multitude of options can be daunting. This necessitates careful consideration and research.

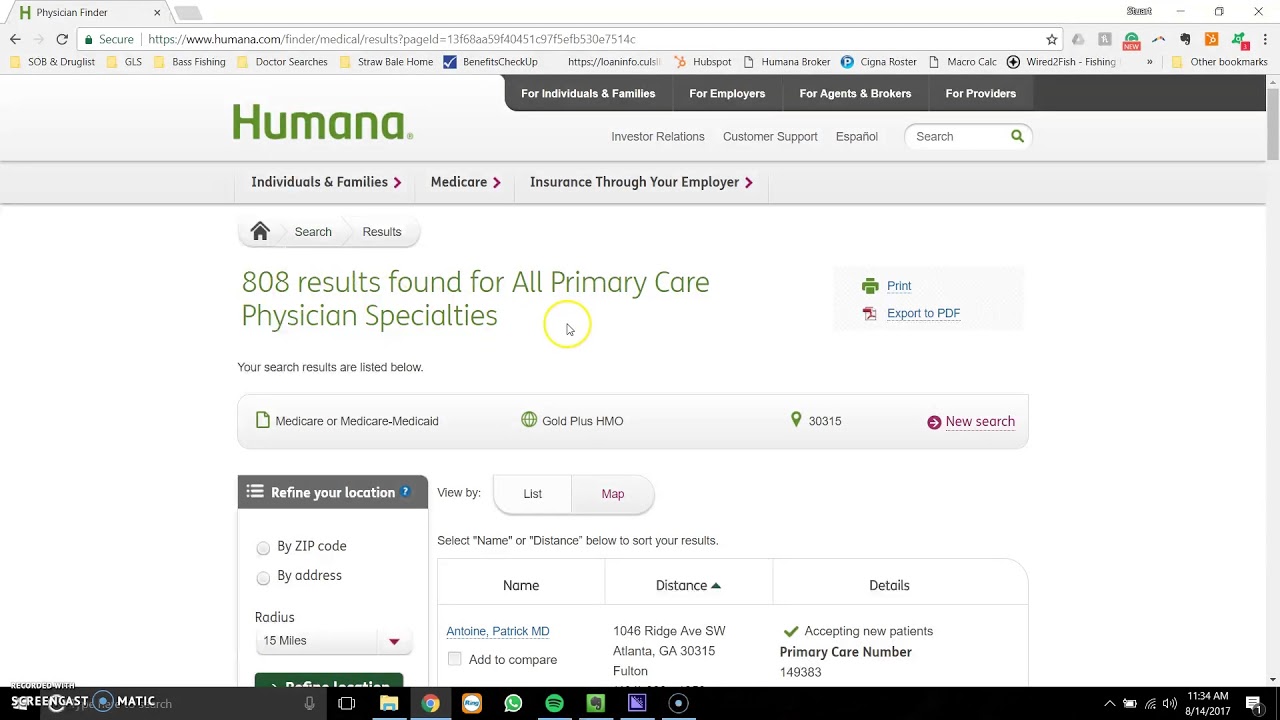

Understanding the specifics of a Medicare Humana Advantage plan is vital. These plans operate within a network of providers, meaning you'll typically need to receive care from doctors and hospitals within that network to maximize your coverage. Choosing a plan requires careful evaluation of your healthcare needs, preferred doctors, and budget. For instance, if you have a chronic condition requiring specialist care, ensuring your preferred specialists are in the plan's network is paramount.

One of the key benefits of Medicare Humana Advantage plans is the potential for cost savings. Many plans offer lower premiums, co-pays, and deductibles compared to Original Medicare. Some plans also include prescription drug coverage, eliminating the need for a separate Part D plan. For example, a Humana Medicare Advantage plan might offer a $0 premium for medical coverage and a low co-pay for doctor visits, potentially saving beneficiaries hundreds of dollars annually.

Another advantage is the bundled benefits. Many Humana Medicare Advantage plans include coverage for vision, hearing, and dental care, services not typically covered by Original Medicare. This comprehensive approach can streamline healthcare management and potentially reduce out-of-pocket expenses for these essential services.

Advantages and Disadvantages of Medicare Humana Advantage

| Advantages | Disadvantages |

|---|---|

| Potential for lower costs | Network restrictions |

| Bundled benefits (e.g., vision, dental) | Coverage limitations outside the network |

| Simplified healthcare management | Plan availability varies by region |

Frequently Asked Questions about Medicare Humana Advantage Plans:

1. How do I enroll in a Medicare Humana Advantage plan? Answer: You can enroll during the Annual Enrollment Period or other eligible special enrollment periods.

2. What is the difference between a HMO and a PPO plan? Answer: HMO plans generally require referrals to see specialists, while PPO plans offer more flexibility in choosing providers.

3. Does Medicare Humana Advantage cover prescription drugs? Answer: Many plans do, but it's essential to check the specific plan's formulary.

4. Can I switch from a Medicare Humana Advantage plan back to Original Medicare? Answer: Yes, you can switch during specific enrollment periods.

5. How do I find a doctor in my plan's network? Answer: You can use Humana's online provider directory or call customer service.

6. What are the out-of-pocket maximums for Medicare Humana Advantage plans? Answer: These vary by plan, so it's important to review the plan details.

7. Are there any restrictions on pre-existing conditions? Answer: No, Medicare Advantage plans cannot deny coverage based on pre-existing conditions.

8. How can I learn more about specific Medicare Humana Advantage plans in my area? Answer: You can visit the Humana website or call their customer service line.

In closing, Medicare Humana Advantage plans present a significant pathway to navigating the complexities of healthcare coverage. These plans offer the potential for lower costs, bundled benefits, and simplified healthcare management. However, understanding the specifics of network restrictions, coverage limitations, and plan choices is crucial. By carefully weighing the advantages and disadvantages, and by utilizing available resources like Humana's website and customer service, individuals can empower themselves to make informed decisions that align with their healthcare needs and financial circumstances. Taking proactive steps to understand these plans can pave the way for a more secure and manageable healthcare journey. Remember, knowledge is power, especially when charting the course of your health and well-being.

Deck handrail codes dont let your deck be the next fail blog post

Conquering chicagos summer half marathon heat

Car battery cut off switches power and protection