Navigating the Humana Gold Choice PPO Landscape

In the labyrinth of Medicare options, the Humana Gold Choice PPO emerges as a distinct path, offering a blend of flexibility and coverage. But what exactly does this path entail? What does it mean to choose this particular route through the healthcare wilderness? This exploration seeks to illuminate the Humana Gold Choice PPO, unraveling its complexities and revealing its potential for those seeking a secure passage through the often-perplexing terrain of healthcare in later life.

Understanding the intricacies of Medicare Advantage plans can feel like deciphering an ancient language. Each plan presents a unique dialect, a specific set of rules and offerings. Humana Gold Choice PPO is one such dialect, a variation on the theme of managed healthcare, designed to provide a balance between cost-effectiveness and access to a broad network of providers. It's a conversation between individual needs and the resources available to meet them.

The Humana Gold Choice PPO stands as a testament to the evolving landscape of healthcare. It represents an attempt to address the growing need for comprehensive and affordable medical coverage within a system constantly in flux. It embodies the pursuit of a harmonious balance between the individual's desire for autonomy in healthcare decisions and the practicalities of cost management.

One of the central questions surrounding any Medicare Advantage plan is its impact on access to care. With the Humana Gold Choice PPO, this question revolves around the concept of the Preferred Provider Organization (PPO). This structure allows beneficiaries to venture outside the designated network, albeit at a potentially higher cost. This flexibility can be a crucial factor for individuals with established relationships with specialists or those living in areas with limited in-network options.

The nuances of the Humana Gold Choice PPO are best understood through a careful examination of its specific benefits and limitations. This requires a deep dive into the plan's formulary, its coverage for various medical services, and the potential out-of-pocket expenses that beneficiaries might incur. It's a process of weighing the advantages against the potential drawbacks, a personal calculus that takes into account individual health needs and financial circumstances.

Humana, a well-established player in the health insurance arena, introduced the Gold Choice PPO as part of its suite of Medicare Advantage offerings. It emerged as a response to the demand for PPO plans, which provide greater flexibility compared to HMOs. The importance of this type of plan lies in its ability to offer a broader network, addressing the concerns of those who value choice and access to a wider range of specialists.

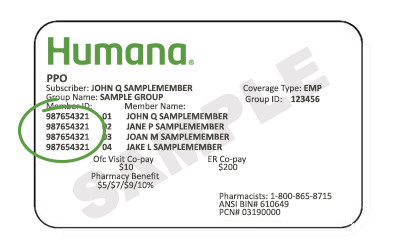

The Humana Gold Choice PPO operates within the framework of a Preferred Provider Organization (PPO). This means that while beneficiaries can see any doctor, they will generally pay less if they see doctors within the plan's network. The "Gold" designation indicates a level of coverage that typically falls between silver and platinum plans, offering a moderate balance between premiums and cost-sharing.

Benefits may include prescription drug coverage, preventive care, and coverage for hospital stays and doctor visits. Examples include coverage for annual wellness visits, certain vaccinations, and generic medications on the plan's formulary.

To choose a plan, research different Humana Gold Choice PPO options in your area, compare costs and benefits, and consider your healthcare needs. Use online resources, consult with a licensed insurance agent, and talk to your doctor about your specific healthcare requirements.

Advantages and Disadvantages of Humana Gold Choice PPO

| Advantages | Disadvantages |

|---|---|

| Access to a larger network of providers | Higher costs for out-of-network care |

| No need for referrals to see specialists | Potentially higher premiums than HMO plans |

| Flexibility to see doctors outside the network | Varying coverage depending on plan specifics |

Frequently Asked Questions (FAQs):

Q: What is Humana Gold Choice PPO? A: It's a Medicare Advantage plan offered by Humana that provides coverage through a Preferred Provider Organization (PPO) network.

Q: How does it differ from an HMO? A: PPOs offer greater flexibility in choosing doctors, while HMOs generally require referrals to see specialists.

Q: Does it cover prescription drugs? A: Many Humana Gold Choice PPO plans include prescription drug coverage.

Q: What are the costs associated with this plan? A: Costs vary depending on the specific plan and location. These costs include premiums, deductibles, copayments, and coinsurance.

Q: How can I enroll in a Humana Gold Choice PPO plan? A: You can enroll during the Annual Enrollment Period or during a Special Enrollment Period if you qualify.

Q: What doctors can I see with this plan? A: You can see any doctor, but you will generally pay less if you see doctors within the plan's network.

Q: Does it cover vision and dental? A: Coverage for vision and dental may vary depending on the specific plan. Some plans may offer enhanced benefits for these services.

Q: Where can I find more information? A: You can visit the Humana website or contact a licensed insurance agent for more information.

In conclusion, navigating the complexities of Medicare can be challenging. The Humana Gold Choice PPO presents a specific avenue within this landscape, offering a blend of flexibility and coverage through its PPO network. Understanding its nuances, from costs and benefits to network limitations, is crucial for making an informed decision. This plan offers potential advantages for those who prioritize access to a wider range of providers and the freedom to seek care outside the network. However, it’s essential to weigh these benefits against the potential for higher out-of-network costs. By carefully considering your individual needs and researching the specific details of available plans, you can embark on a path that best suits your healthcare journey.

Crafting the perfect ohio llc name examples and insights

Decoding rahway dmv hours in new jersey

Sherwin williams ready match touch up paint a deep dive